If your goal is to save money, you don’t need a complicated budgeting system. You just need a system that helps you spend less.

Systems like YNAB offers obviously work for some people just based on the number of fans it has. But it doesn’t work for everyone. It didn’t work for us. We didn’t get past figuring out how to set everything up and keep track of all the YNAB rules. And here’s what I realized: I don’t want a finance-tracking system. Our household is not a small business, so it doesn’t need small-business accounting software. Our goal is to spend less than we earn and to put the excess aside for emergencies, vacations, retirement, and other goals we have.

So I started questioning long-standing budgeting assumptions.

Why should I budget for a month?

A month is a long time. A lot can happen in a month that I can’t plan for. If I budget for a whole month, I will inevitably be wrong. I will inevitably have to do extra work to update the budget as unexpected things come up. You can come up with rules to handle the problem created by a monthly budget or you can realize that the monthly budget is the problem.

Why should I keep track of fixed, recurring costs?

Housing costs are inevitable. Whether I write it down or do not, I still pay it. And it is about the same each month. Since my goal is saving money and not necessarily tracking every dollar I spend, I don’t need to put this in my budget. There are other things that I spend money on that I also have no control over. Writing these down will not save me money, so I don’t write them down.

Why should I budget based on categories?

Think of how much time you will spend deciding which purchases should go in which categories. Think of how often you will need to borrow money from one category to meet unexpected needs in another category. Now, if you just like to see where your money is going, that’s one thing. But categories are not required for saving money.

How we budget with SpendWeek

Taking all that into account, we worked out a much simpler budgeting system. These are the steps:

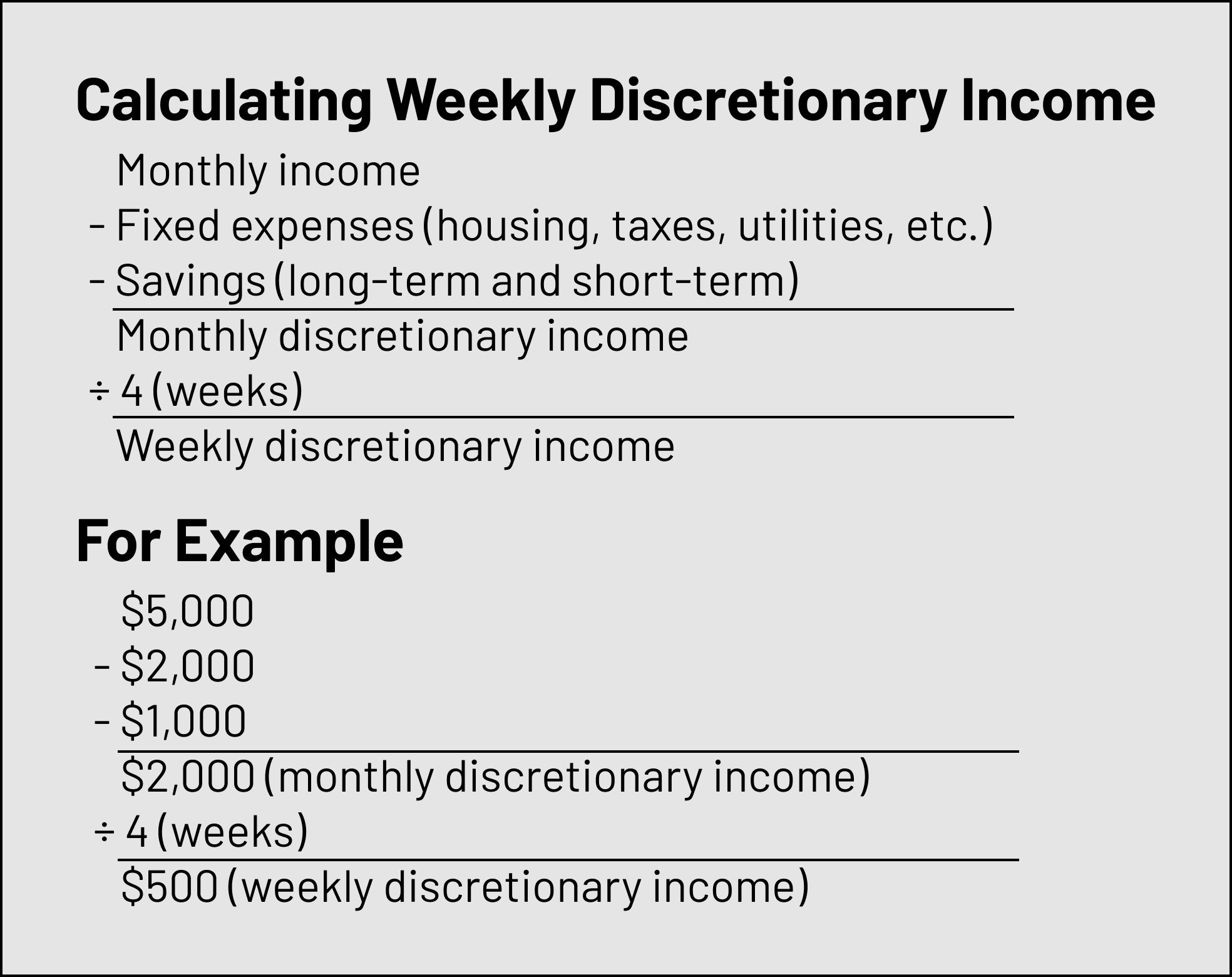

- Calculate your weekly discretionary income (you only have to do this once until your income or fixed expenses change):

- Use the weekly discretionary income value as your weekly spending limit. Set it in SpendWeek at https://www.spendweek.com/app#/admin/settings.

- Decide which day you do most of your purchases. Set this as the day of the week that your weekly spending resets to 0.

- Record all discretionary purchases (the ones that didn’t come out of your monthly income above) in SpendWeek.

- SpendWeek will keep a tally of all your spending for the week.

- When you reach your spending limit for the week, stop spending.

- If you don’t, you know that money is coming out of your savings or fixed expenses. Remember what you are saving for!

- However, if it’s the last day before your spending tally resets and you have money left, call up your friend and go out to lunch. Or go see that movie, grab an ice cream with your kids, make a donation to your favorite non profit. It’s freeing to know you don’t have to feel guilty for having a little fun at the end of the week. You can do that when you know you aren’t cutting into important expenses or savings.

SpendWeek

I built SpendWeek with these ideas in mind. The main focus is using tracking and a spending limit to reduce spending. It’s simple and it works. Give it a try! https://www.spendweek.com